Car Insurance in Pakistan

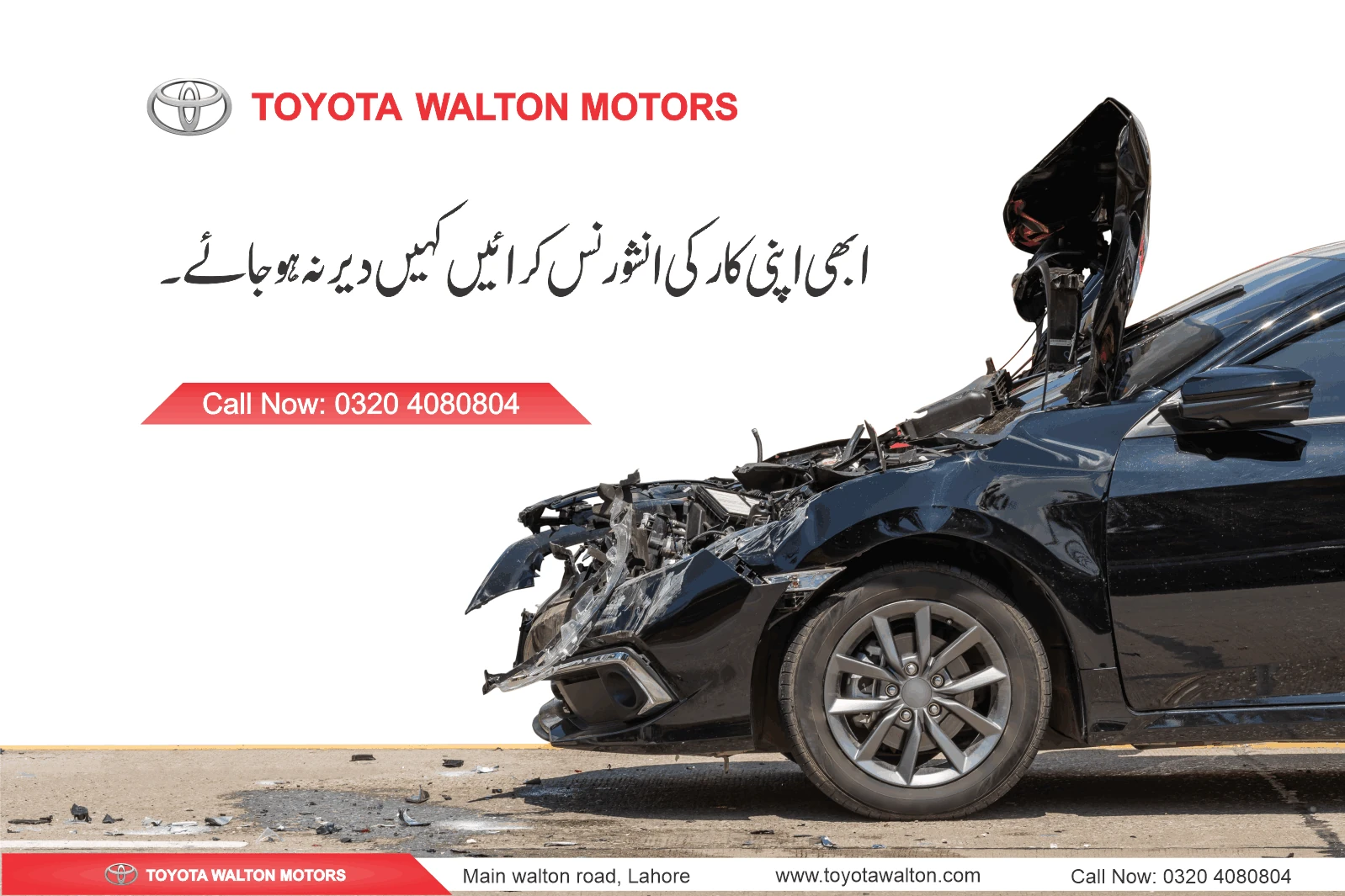

Car insurance is a requirement for driving in Pakistan, and there are several types of car insurance policies available in Pakistan. Toyota Walton Motors give you Huge Discount on Car Insurance.

The two most common types of car insurance policies in Pakistan are third-party insurance and comprehensive insurance.

- Third-party insurance covers damages caused by your car to other vehicles or property, as well as any injuries sustained by other people in an accident. This type of insurance is mandatory in Pakistan.

- Comprehensive insurance, on the other hand, covers damages caused by your car as well as any injuries sustained by you or other passengers in an accident. It may also cover theft, fire, and other non-collision incidents.

When purchasing car insurance in Pakistan, it’s important to shop around and compare policies from different insurance providers to find the best coverage and rates for your needs. Additionally, you should carefully read the terms and conditions of any insurance policy you are considering to ensure that you understand the coverage and any exclusions or limitations that may apply.

Where i buy cheap car insurance in Pakistan?

Get Car Insurance from TOYOTA WALTON MOTORS Contact No: 03204080804

Insure your car for hassle-free claims and get Cheap rate for your Auto Insurance.

What is auto insurance?

Auto insurance is a type of insurance policy that provides financial protection against damage or loss that occurs as a result of an accident or theft involving a motor vehicle. It can also provide coverage for liability, which means that it can help pay for any damages or injuries that you may cause to other people or their property while driving.

Auto insurance policies typically include several types of coverage, such as:

- Liability coverage: This coverage helps pay for any damages or injuries that you may cause to others while driving.

- Collision coverage: This coverage helps pay for damage to your own vehicle in the event of an accident, regardless of who was at fault.

- Comprehensive coverage: This coverage helps pay for damage to your vehicle that is not caused by an accident, such as theft, vandalism, or natural disasters.

- Personal injury protection (PIP) or medical payments coverage: This coverage helps pay for medical expenses if you or your passengers are injured in an accident.

- Uninsured or underinsured motorist coverage: This coverage helps protect you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages.

Auto insurance is required by law in most states, and the cost of the policy can vary depending on several factors, such as your driving history, the type of vehicle you have, and the amount of coverage you need.

How many type of car insurance in Pakistan?

In Pakistan, there are mainly two types of car insurance:

- Third-Party Liability Insurance: This type of car insurance is mandatory by law in Pakistan. It covers the damages or losses caused by the insured to the third party, such as their vehicle or property, in case of an accident. It does not cover any damages or losses to the insured’s own vehicle or property.

- Comprehensive Car Insurance: This type of car insurance provides coverage for both the insured’s own vehicle and property, as well as for damages or losses caused to third parties. Comprehensive car insurance also covers damages or losses due to theft, fire, natural disasters, and other incidents that are not covered under the third-party liability insurance.

Some insurance companies in Pakistan may also offer additional coverage options, such as personal accident coverage for the driver and passengers, roadside assistance, and car rental services. However, these are usually optional and come at an additional cost.

What is third party liability insurance

Third-party liability insurance is a type of insurance policy that covers the damages or losses caused by the insured to a third party, such as their vehicle or property, in case of an accident. This type of insurance is mandatory by law in most countries, including Pakistan.

In the context of car insurance, third-party liability insurance covers the following:

- Bodily Injury: If the insured driver causes an accident that results in injury to another person, the third-party liability insurance will cover the medical expenses, hospitalization costs, and any other related expenses.

- Property Damage: If the insured driver causes an accident that results in damage to another person’s vehicle or property, the third-party liability insurance will cover the cost of repairing or replacing the damaged property.

It’s important to note that third-party liability insurance only covers damages or losses caused by the insured driver to a third party. It does not cover any damages or losses to the insured’s own vehicle or property. For that, the insured would need to purchase a comprehensive car insurance policy.

What is Comprehensive Car Insurance?

Comprehensive car insurance is a type of car insurance policy that provides coverage for damages or losses caused to the insured’s own vehicle and property, as well as for damages or losses caused to third parties. This type of insurance policy is optional and is not mandatory by law in most countries, including Pakistan.

In the context of car insurance, comprehensive car insurance covers the following:

- Own Vehicle Damage: If the insured’s vehicle is damaged due to an accident, theft, fire, natural disasters, or any other covered incident, the comprehensive car insurance policy will cover the cost of repairing or replacing the vehicle.

- Third-Party Liability: If the insured driver causes an accident that results in injury to another person or damage to their vehicle or property, the comprehensive car insurance policy will cover the cost of compensating the third party.

- Personal Accident Coverage: Some comprehensive car insurance policies also provide coverage for the driver and passengers in case of injury or death in an accident.

- Additional Coverage: Depending on the policy, comprehensive car insurance may also provide coverage for additional incidents such as car theft, vandalism, riots, and more.

It’s important to note that comprehensive car insurance policies usually come with a higher premium than third-party liability insurance policies. However, they offer more extensive coverage and can provide greater peace of mind to the insured.

10 Things You Need to Do After a Car Accident

If you’ve been in a car accident, it’s important to take certain steps to protect yourself and ensure that you get the help you need. Here are 10 things you should do after a car accident:

- Check for injuries: The first thing you should do is make sure everyone in your car and the other car is okay. Call for emergency medical services if necessary.

- Call the police: Even if the accident seems minor, you should always call the police. They can document the accident and create an official report, which may be useful later.

- Exchange information: Get the name, contact information, and insurance information of the other driver(s) involved in the accident.

- Take photos: Take photos of the scene of the accident, including any damage to the cars, any injuries, and the surrounding area.

- Talk to witnesses: If there were any witnesses to the accident, get their contact information.

- Contact your insurance company: Report the accident to your insurance company as soon as possible.

- See a doctor: Even if you don’t think you’re injured, it’s important to see a doctor as soon as possible after an accident. Some injuries may not show up right away.

- Keep track of expenses: Keep track of all expenses related to the accident, including medical bills, car repairs, and any other expenses.

- Don’t admit fault: Never admit fault for an accident, even if you think it was your fault. you can asked Its a Accident only.

- Consult with an attorney: If you’re unsure about your legal rights or if you’ve been injured in the accident, consult with an attorney who specializes in personal injury law.